SNX Market Stats (SYNTHETIX)

SNX Price

$ 1.13

-4 %

SNX Market Cap

$ 387,068,090

234th

24h Trading Vol.

$ 85,044,793

Current Supply

343,466,217

Diluted Valuation

$ 387,545,502

Max Supply

343,889,850

Links

Synthetix

Synthetix is a derivatives trading protocol on the Ethereum blockchain where holders of the Synthetix Network Token (SNX) are shareholders of the network and receive fees from every trade. In this deep dive we explore how Synthetix works, how you can stake your SNX to earn fees and how to trade on the Synthetix exchange.

What is a Derivative?

To understand the scope of the Synthetix protocol’s ambition one needs to have a basic understanding of what derivatives are. In traditional finance, the 3 main categories of financial instruments are debt (bonds, mortgages), equity (stocks), and derivatives. In a nutshell, a derivative is a contract between two parties that tracks the price of an asset, referred to as the “underlying”, without any of the two parties actually holding the asset. Since neither party holds the underlying, the contract needs to be backed by acceptable collateral (USD, Euros, etc…) so the trade can be settled.

Out of all 3 categories, derivatives are by far the largest of the three; Synthetix is disrupting the largest segment of finance.

Derivatives in DeFi

Derivatives are popular in DeFi as they allow constructing any real-world asset on the Ethereum Blockchain in the form of tokens where they can be traded globally without any of the barriers present in traditional financial markets.

One famous use case for a derivative in DeFi are stablecoins. The MakerDAO protocol for instance issues a token called DAI, which tracks the value of the US dollar without actually having to hold any real dollars (as this would inevitably make the system centralized).

Instead, the MakerDAO protocol uses Ether and other crypto assets as collateral. Anyone can open a Maker vault, deposit Ether and receive DAI in return. In the case of ETH, you can generate 100 DAI by locking an amount of ETH that is worth at least 150 USD; that is, the collateralization ratio is 150%. And you can also generate DAI using other assets, like BAT, USDC and WBTC. The system knows the real price of USD relative to the collateral assets through so-called “oracle price feeds”, which help it to adjust the collateral requirements such that it always has enough value backing the price of DAI.

The system could be replicated to create other synthetic assets such as a Euro stablecoin or synthetic gold. However, the way Maker is set up, these synthetic assets would then be isolated from each other. To trade synthetic dollars against synthetic gold you would effectively swap two entirely different assets which means you would face high slippage costs absent of deep liquidity on that trading pair.

Synthetix protocol: one collateral pool, any synthetic asset

The synthetic protocol has one single collateral pool and is able to mint any synthetic asset existing in the real (off-chain) world or on-chain as long as it has a price feed.

Stakeholders in the Synthetix protocol stake their SNX and receive sUSD in return. Once this step is completed they have a debt towards the protocol denominated in sUSD. While sUSD is always the entry point into the Synthetix protocol it can then be used to trade against any other synthetic asset present in the protocol like the sBTC, sXAU (gold) or sNIKKEI (Japanese stock index). The real game changer here is that there are 0 slippage costs when you trade your sUSD against sXAU because you’re not dependent on a counter-party ‘selling’ you the asset but simply converting the denomination of your debt.

The combined market value in USD of all the synths in the pool is known as the “debt pool”. As people trade synths, for example sUSD against sBTC the composition of the debt pool changes. As an SNX staker you assume responsibility for potential profits of synth holders in return for fees and SNX rewards. If you use some SNX to mint 1000 sUSD, and if the total debt in the system (the debt pool) is then worth 100K USD, you’ll owe 1% of it. If the total debt in the pool increases in value to, say, 150K, you’ll still owe 1% of it. In that case, your debt will be 1500 sUSD. SNX stakers take on risk but get rewarded for doing so.

Understanding The Debt Pool

As we established, as a staker you’re assuming the debt of the protocol and get trading fees and SNX rewards. If the value of synths goes down, stakers make money since they have less obligations to meet. Conversely, if the value of the debt pool goes up, staker lose (unless trading fees and SNX rewards offset the rise of the debt pool).

Let’s say the debt pool is 2000 sUSD and you mint SNX to add 1000 sUSD, which you instantly sell. Now a trader comes, buys those 1000 sUSD and converts them to 0.1 sBTC on the synthetic.exchange. In total the debt pool then has a value of $3000 and it is composed of 0.1 sBTC and 2000 sUSD. Your share of that debt is 33%.

Now let’s imagine the price of bitcoin (sBTC) doubles to $20,000. This would bring the USD value of the debt pool to $4000 instead of $3000. Your share of the debt pool will still be 33% but the absolute value of that debt is now $1333. If you want to unlock your staked SNX, you now have to pay $1333 sUSD, meaning you would have incurred a loss of $333 ($1333 - $1000).

If the price of sBTC halves on the other hand, the value of the debt pool will be $2500.Your share will still be 33% and the absolute value of your debt will be 833 sUSD. If you decide to unlock your staked SNX now, you have to pay 833, meaning you would have incurred a gain of $177 ($1000 - $833) + your share of trading fees and SNX rewards in the time period .

Naturally, as a staker you don’t have to hold sUSD. You could also convert your sUSD in sBTC or another synth yourself and hope that it will increase in value. In an optimal scenario however, the debt pool should be neutral, meaning there are an equal amount of traders betting on a rise of the assets in the pool than on the fall. In this case, while at an individual level some traders win and others lose, the aggregate value of the debt pool does not shift in USD value; meanwhile, the stakers collect fees while keeping their debt level constant. This is why Synthetix offers the inverse for every asset that exists, traders who want to bet on the asset price increase hold sBTC those who want to short it buy iBTC.

Since most traders in crypto want to be long on crypto assets, Synthetic currently rewards users who go short and hold iETH or iBTC, to further incentivize pool neutrality. As the Synthetix system matures, it’s also important that more uncorrelated assets and especially off-chain assets like stocks and commodities get added.

Synthetix for traders

The average trader of course doesn’t need to understand all of these complexities. They don’t have to stake SNX or mint sUSD. They can immediately convert their US stablecoins (DAI, USDC etc.) to sUSD or their ETH to sETH on decentralized exchanges like Uniswap or DEX aggregators like Paraswap. From there they can buy any synthetic asset available on the Synthetix exchange with 0 slippage.

Synthetix for stakers

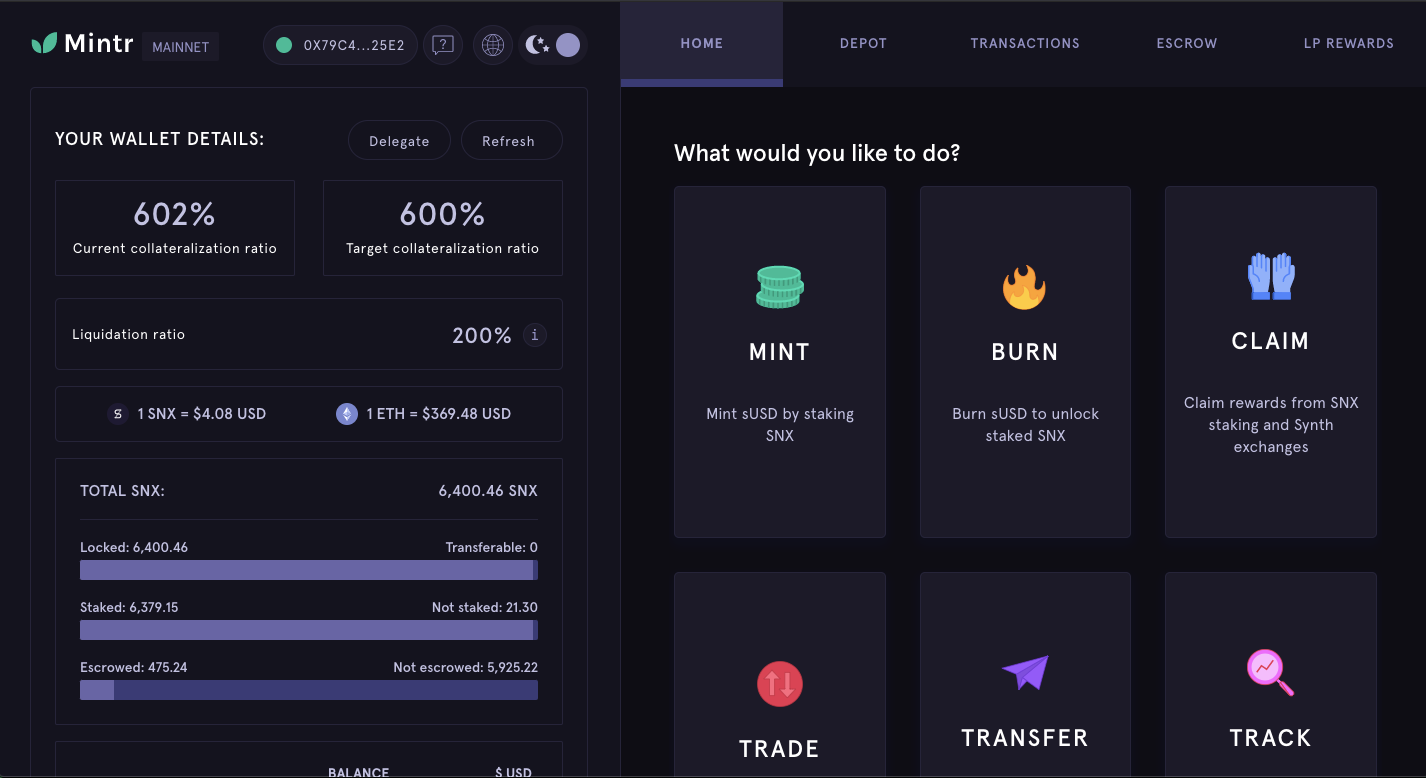

Synths are created by users who stake SNX tokens for fees and rewards; when a SNX holder stakes, they post their SNX as collateral and create new Synthetic USD (sUSD) debt obligations that get added to the debt pool. This all happens on Mintr, an interface created by the Synthetix team where stakeholders can manage their debt and collect their weekly SNX rewards.

To ensure that the system can always honor its debt obligations towards synth holders, even in times when the market is volatile, it has to be sufficiently collateralized. Currently, the required collateralization ratio is 600% meaning you have to lock at least $6000 worth of SNX to receive $1000 sUSD. If the value of the debt pool increases, so does your pro-rata share of the debt pool. This means your collateralization ratio can drop below the required 600% if the market is volatile.

To incentivize stakers to maintain their debt at a healthy level, the Synthetix protocol blocks stakers from claiming their weekly SNX rewards for as long as it’s below 600%. Stakers have three options to get their debt level back to the required threshold: by waiting for the SNX price to increase again, locking more SNX or pay back (‘burn’) some of your sUSD debt. Further, if the collateralization ratio *drops below 200%, SNX collateral gets liquidated.

Challenges & Solutions in the Synthetix protocol

In order to function at scale, Synthetix needs a large debt pool and deep liquidity pools on secondary exchanges where traders can swap their synthetic assets against the underlying ‘real’ asset.

Let’s see why these issues are important and how the protocol addresses them.

Synth Growth Limited By Collateralization Requirement

Although the high collateralization requirement is necessary to guarantee the solvency of the system it puts a limit on the amount of synthetic assets the system can issue at any time. Currently, the value of all synthetic assets issued by the Synthetix protocol are worth $117m dollars. The market cap of SNX is $800m.

For the system to become interesting to large institutional traders, it’s important that the debt pool grows beyond its current value, so more synths can be issued in order to accommodate larger trades.

1. SNX rewards

One way the protocol addresses this issue is by distributing SNX rewards to all SNX holders staking their SNX. This incentivises SNX holders to stake and punishes those who don’t actively participate in staking as their holdings get diluted by the inflation (their pro-rata share of SNX decreases). Synthetic was the first DeFi protocol to introduce this inflation and it has worked incredibly well as close to 90% of all SNX is staked in the protocol! This means the system is close to the maximum of synths it can issue but it is still constrained by the value of the debt pool.

2. ETH as collateral

Synths can also be minted by holders of ETH who post their ETH as collateral at a c-ratio of 150% (ETH/sETH). For example, a user with 150 ETH can lock their ETH and mint 100 sETH (unlike SNX stakers who mint sUSD). By doing so, ETH holders are able to obtain leverage for their assets. Since their debt to the protocol is denominated in sUSD they can bet on a rising ETH price (or other synth if they convert) and pay back their debt at a discount.

However, sETH minters are not stakers and do not have any obligation against the debt pool. Instead, they simply owe back the sETH they borrowed. sETH minters bear no responsibility for the success of other traders in the debt pool and they do not collect fees and rewards.

The importance of a stable peg & Deep Liquidity

The peg for each synth is the exchange rate at which traders can convert the real underlying asset against the synthetic version (e.g. sUSD:USD, sETH:ETH, sBTC:BTC, etc…). Ideally, all synths should be pegged at 1:1 with their respective underlying, even at large trading volumes between synths and real assets.

It’s crucial that synths are pegged 1:1 to their underlying asset as all participants in the Synthetix ecosystem need to be able to exit and enter the system at low cost. SNX stakers for instance receive trading fees in the form of sUSD. If sUSD is not easily exchangeable for USD, then trading fees have no ‘real’ value outside of Synthetix. Similarly, if a trader makes large profits from swapping between synths and doubles their USD value, they need an easy way to exchange those synths for real assets like USD, ETH, BTC and others. Finally, if someone wants to buy a synth to use the synthetix.exchange and access the derivatives, they need a way to turn their USD into sUSD (or ETH into sETH etc.)

To ensure there is sufficient liquidity for synths on secondary markets like Uniswap, Balancer or Curve the protocol distributes SNX rewards to liquidity providers. For instance, you can provide liquidity on the sUSD or sBTC pool on Curve and earn SNX rewards. These rewards help to bootstrap liquidity while the trading fees alone are still insufficient for liquidity providers.

Governance

The Synthetix protocol is built on the Ethereum blockchain; it is a decentralized trading platform where no single individual or core contributor is responsible for the functioning of the system. The system runs autonomously of any human intervention on the Ethereum network and can be used by anyone in the world.

The project has established a Synthetix Improvement Proposal (SIP) process, which allows anyone in the community to put forward improvement proposals related to the protocol. All SIP's are discussed and expanded upon by the community in Github as well as the Synthetix Discord channel. However, the core team behind Synthetix is still responsible for implementing and pushing most of the roadmap items. The core team also holds the admin keys to upgrade the system in order to implement the roadmap. Eventually, the whole governance (including admin keys) is going to be handed over to the community

Meanwhile, the GrantsDAO, which decides how to allocate developer & marketing grants, is already run by the community.

Ecosystem & tools

Kwenta.io

Kwenta provides a sleek alternative user interface to trade synthetic assets. Under the hood it uses the Synthetix protocol.

TAKE ME THERESNX Community & influencers

Kain Warwick - Founder

@kaiynne

Garth Travers - Head of Community

@@garthtravers

We are a multi-faceted team of crypto enthusiasts based in Berlin.

© 2021 cryptotesters UG

Products

Cryptocurrency exchanges

Crypto wallet guide

Crypto savings accounts

Defi lending rates

Crypto cards

Exclusive crypto deals

Ethereum staking

Resources

Articles

Reviews

Podcasts

Tutorials