A Comparison of DeFi Index Projects

Emanuel Coen

over 1 year ago ·

12 min read

It is well established that in order to grow your personal wealth - you need to invest. Luckily, you don’t need to be a token-picking genius in order to invest into the fast growing DeFi sector like a professional - you can simply invest in a DeFi index which automates your entire investment strategy for you.

An index fund (ETF) is a portfolio or basket of assets constructed to match or track the components of a financial market sector, such as the Standard & Poor's 500 Index (S&P 500). When a certain asset goes up or down in price, the index will re-balance and return to the percentage allocation it aims for that particular asset.

This model of investing allows investors to develop a passive form of portfolio management strategy and takes away a lot of the workload required to manage a successful portfolio. One of the largest benefits of an index is that it offers diversification. By spreading your investment over a number of assets you are taking less risk than if you would only invest in one.

“Don’t look for the needle in the haystack. Just buy the haystack!” John C. Bogle

Would you have picked Amazon from the 1000’s of internet companies emerging in the dot-com era? Probably not. Betting on a Internet Tech fund on the other hand would have been a far less controversial bet and would equally have paid off handsomely.

Index funds are starting to become popular in the DeFi space, with several projects like Indexed.Finance, IndexCoop and PieDao each experimenting with different mechanics. A DeFi index differs from traditional indices in that all the investment operations are automated and executed by smart contracts instead of human fund managers. Moreover, the governance of DeFi index protocols is oftentimes completely decentralized, meaning that token holder can decide the future direction of these indices and set the most important parameters.

Why should I buy a DeFi index?

Especially in times of a bull market where an entire sector is performing well (on average), it is oftentimes more attractive and more convenient to pick up an index token tracking an entire sector than to individually pick winners & losers.

Not to mention that for many newcomers with smaller budgets (<$5k) it is much more gas-efficient to buy a DeFi index token and get exposure to 10 projects in one trade, than buying the 10 tokens individually. Not to mention, that the Top 10 hottest projects change frequently, what could have been the best DeFi projects a month ago will be forgotten a couple of months later. A DeFi index would automatically adjust to the new reality and include the new DeFi token projects into its index.

However, with all the index projects to choose from, it can be hard for retail investors to pick the right DeFi index for their needs.

In this article we’ll try to give you a quick overview of the different DeFi index projects. For those who want to learn more about the technical subtleties we'll attempt to break down the differences between these projects in thelater sections, focusing on three characteristics: indexing methodology, portfolio structure and rebalancing. These are the core components of any DeFi index and largely determine its performance (assuming they track the same assets).

Which is the best DeFi index to buy?

Before we go into the technical differences let's go over the three things that matter most to investors when choosing which DeFi index to buy.

- Performance

- Asset selection

- Fees

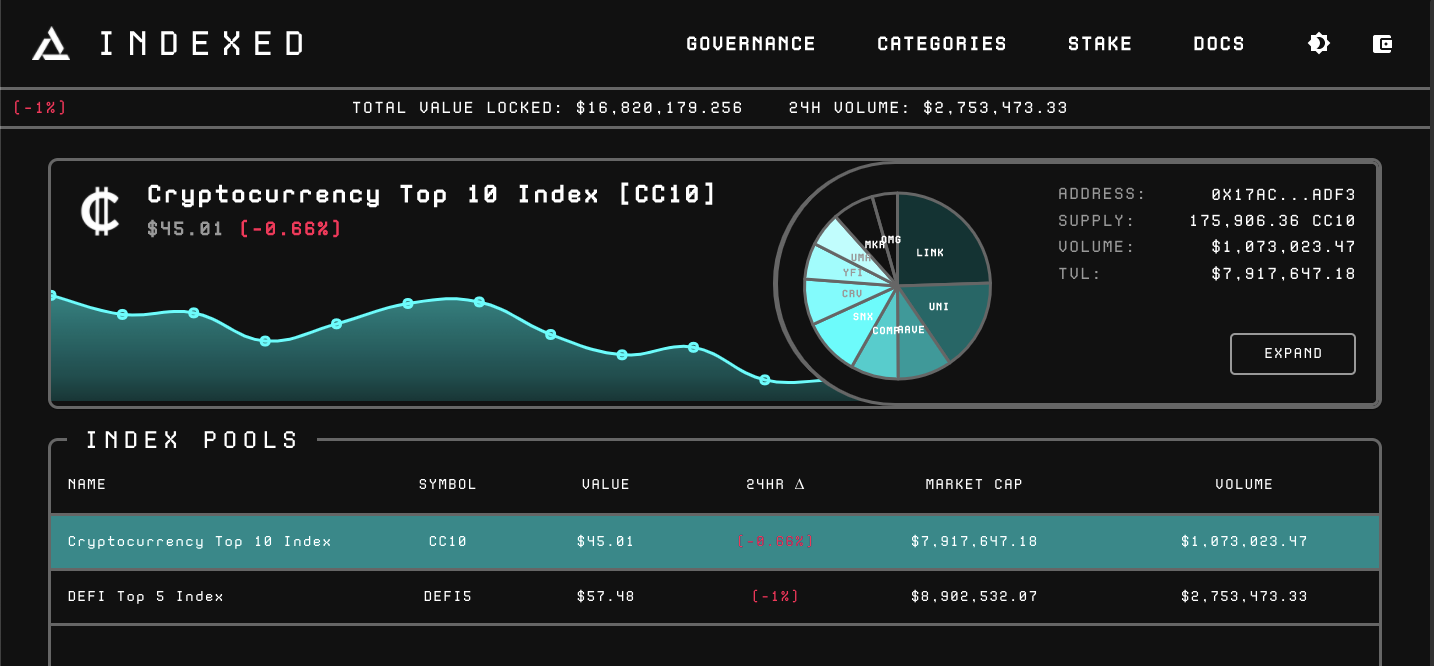

Based on these criteria it seems like DEFI5 and CC10 from indexed.finance are the best index picks. Their performance has been excellent and on top of that they are the only two indices that don't charge holders a management fee.

DEFI5 tracks the Top 5 assets in the DeFi space, the so called "blue chips", whereas CC10 is a bit broader and incorporates five more assets as shown in the graphic above.

How do these DeFi indices differ?

Now let's explore the differences between various DeFi index projects. The core components of any DeFi index are its methodology, the portfolio structure and the rebalancing method to bring the asset weights back to target.

Indexing methodology

Indexing methodology includes the criteria tokens need to meet in order to be considered in an index as well as the method of weighting them within the portfolio, both initially and when setting rebalancing targets.

Portfolio structure

Portfolio structure refers to the type of contract used to hold the index’s underlying tokens, whether those assets are used to generate additional revenue by being deployed in other DeFi protocols, and any relevant fees.

Rebalancing

Rebalancing describes how a fund changes its composition to match the weight targets set by the indexing methodology. This needs to happen in order for the index to accurately track the performance of its underlying tokens. If the market cap of one token in the index rises for example and another one declines, the index might need to increase its exposure (weight) to the increasing token.

If you don’t understand what these terms mean, don’t worry, they will become more clear as we go through examples.

Index Coop

-

Indices: DPI ($AAVE, $SNX, $UNI, $MKR, $YFI, $COMP, $LRC, $REN, $KNC, $BAL)

-

TVL: $130M

-

Governance token: Yes

-

Liquidity Mining: Yes - for staking DPI - ETH

-

Fee: 0.95% annualized

Index Coop is a project building crypto indices on Ethereum. The governance token INDEX is used to make decisions regarding upgrades, maintenance and deployment of indices. At present, Index Coop has a single index: the DeFi Pulse Index (DPI), which is a token set using Set Protocol as the underlying framework.

Indexing Methodology

DPI is managed by INDEX governance, which uses criteria based on token and project characteristics to determine eligibility for the inclusion of an asset within the index. Tokens are weighted by circulating market cap as collected from Coingecko.

On the third week of each month, DPI has a Determination Phase, where INDEX token holders reweigh the current tokens in the index and submit any additions or removals of tokens in the index and submit them on chain. Other holders can then verify the accuracy of this data and approve the resulting targets for the index’s portfolio composition.

Further details about the indexing methodology can be found on pulse.inc.

Portfolio Structure

DPI is a Set Protocol “token set”, and is similar to a traditional index fund in that DPI tokens represent proportional ownership of the underlying assets, which are held in the set amounts proportional to their weights until each rebalance. DPI tokens can be issued to users who deposit the underlying tokens in amounts proportional to their weights, or redeemed to claim the underlying tokens.

Evidently, most users don’t issue the DPI by supplying the individual tokens but rather market buy it on decentralized exchanges like Uniswap or on the IndexCoop website.

DPI charges a 0.96% Streaming Fee, which is an annual percentage of the index’s market cap which the manager (Index Coop) may claim.

Rebalancing

On the first business day of each month, DPI begins a Reconstitution Phase. In this phase, smart contracts are used to execute trades on decentralized exchanges to rebalance the index toward the weight targets set in the Determination Phase, as well as add and remove tokens from the index. This occurs over the course of the day so that trades may be chunked to minimize slippage.

PieDAO

-

Indices: 6 (BCP, DEFI ++, DEFI +L, DEFI+S, BTC ++, USD ++)

-

TVL: $15M

-

Governance token: Yes - $DOUGH

-

Liquidity Mining: Yes - for supplying liquidity to 3 BCP, DEFI+S or DEFI+L on Balancer in combination with ETH

-

Fee: varies but most indices have a 0.58% streaming fee

PieDAO is a protocol for managing ETFs, which are referred to as “Pies”. The governance token DOUGH is used to vote on decisions regarding deployment of pies, protocol upgrades and selection of underlying assets and weights within Pies.

Pies take a variety of forms, with some being similar to token sets with constant assets and weights, and others acting as a sort of mix between mutual funds and index funds, with pre-set rules that take both DOUGH holders’ sentiments and market data into account when assigning tokens and weights.

Note that PieDao also has a second product called PieVaults, which we covered previously. PieVaults also track the performance of a set of underlying tokens but additionally they lend assets in various DeFi lending protocols such as Compound & Aave to generate yield. That means the vaults are not 100% collateralized, which makes it a more risky product than a normal index, and why we didn’t include it here.

DOUGH holders may create and vote on governance proposals to deploy new pies or rebalance existing ones, but each pie has its own methodology:

BTC++ is a basket of equally-weighted Bitcoin wrapper tokens, while USD++ a basket of US dollar stablecoins has weights assigned by governance according to the tokens’ perceived trust minimization qualities and stability relative to the dollar.

DEFI+L includes large cap DeFi tokens, weighted by governance using a combination of tokens’ market caps and their Sentiment Scores, which are based on DOUGH holders’ views of the projects’ relative potential for growth and other characteristics such as their P/S ratio.

DEFI++ is a mixture of 70% DEFI+L tokens and 30% DEFI+S tokens.

Portfolio Structure

Pies are Balancer Smart Pools with swap fees typically set to 1%. This means that the underlying tokens of each index sit in a AMM liquidity pool. Each token in a pie has a weight in the contract which represents the proportion of the total Pie value held in that token. Tokens within Pies can be traded at prices determined by their weights and balances, as well as the swap fee.

By using an AMM as the holding mechanism for their liquidity, pies can generate returns beyond the growth of the underlying tokens whenever the fees accrued through swaps are greater than the impermanent loss from arbitrage.

Pies each have their own streaming fees, paid out linearly to DOUGH holders as a proportion of the Pies’ market caps.

Rebalancing

When PieDAO modifies the target weights for the underlying assets in a pie, they do not immediately take effect. Instead, a “poke” function on the pool is used to slightly adjust tokens’ weights toward their target weights set by governance.

This creates small arbitrage opportunities (moments at which the prices in the AMM are not on par with the external market) within the pie which arbitrageurs can execute to move the actual balances toward their targets. Weight adjustments are executed linearly over a number of blocks so that pokes can not happen in quick succession.

Over time this allows large scale rebalancing of the pool without relying on external markets to execute rebalancing trades.

Indexed Finance

-

Indices: 5 (DEFI5, CC10, DEGEN, ORCL5, NFTP)

-

TVL: $30M

-

Governance token: Yes - $NDX

-

Liquidity Mining: Yes - for supplying liquidity to DEFI5 or CC10 on Uniswap

-

Fee: No fee

Indexed Finance is a protocol focused on passive portfolio management. This means that the entire re-balancing and re-weighting of the indices happens automatically through on-chain processes.

Governance is only needed to vote on decisions such as market sector definitions ( which projects should be considered for a new index), deployment of indices and approval of new management strategies.

Indexing Methodology

The current indexing strategy tracks specific market sectors, which are initially defined by governance with a set of criteria for token eligibility. A controller contract stores a list of tokens for each sector (up to 25 tokens) which is managed by governance according to the sector’s inclusion criteria.

Market sectors’ tokens are periodically sorted on-chain by their fully diluted market caps, which are extrapolated from their moving average prices as recorded on a Uniswap oracle. When an index pool is deployed, it is assigned a target size which is used to select the top tokens in that market sector. For example, the CC10 index has 10 tokens and its corresponding market sector list might have 15 tokens.

At deployment, tokens are weighted by the square roots of their market caps. Once a week, these weights are recalculated and assigned as new target weights on the pools autonomously. Each time a pool has been re-weighed four times, it may be re-indexed, meaning the index might remove on asset and swap it out for the next best candidate from the category list.

Portfolio Structure

Index pools use a fork of Balancer with modifications that enable gradual re-weighing and re-selection of the underlying assets. Each token in the pool has a weight which represents the proportion of the total pool value held in that token. Tokens within a pool can be traded at prices determined by their weights and balances, as well as the pool’s swap fee, which is 2.5%.

By using an AMM as the holding mechanism for liquidity, index pools can generate returns beyond the growth of the underlying tokens whenever the fees accrued through swaps are greater than the impermanent loss from arbitrage. Note, the fee is higher than PieDAO’s to protect users from impermanent loss.

Rebalancing

When the controller updates the weight targets on a pool, they do not immediately take effect. Instead, the actual token weights are moved toward their target weights whenever swaps are executed, with a maximum frequency of once per hour. This creates small arbitrage opportunities over time which arbitrageurs can execute to move the actual balances toward their targets.

When a new token is added through re-indexing, the pool uses price data from Uniswap as well as the pool’s own market cap to price swaps for that token within its AMM until the balance reaches 1% of the pool’s value, after which it is priced normally.

DPI vs. PieDao & Indexed

As an index holder the technicalities behind the different index implementations might not really matter for you on the first sight but on the long-term they have an impact over the performance of the index token you hold.

For example, consider the way the different indexes re-balance. During a rebalancing a part of the tokens are sold to reach the target weights assigned by the protocol. In the case of the DPI index, this happens once a month, after the index has been assigned new weights by the methodologist (the core team).

This means that the index holders are exposed to the price movements of that particular day when the DPI index re-balances. It might be the case that on the particular day the DPI buys new tokens they are at peak prices.

PieDao and Indexed.Finance both have a different portfolio structure. Here, the assets sit in an AMM liquidity pool and the re-weighting happens gradually as traders trade with the pool and thereby bring the balances to where the pool wants them to be. Since the buying happens gradually and never all at once, the pools are able to re-balance at cheaper prices.

For example, if the pool wants to decrease its exposure to the AAVE token, it will gradually decrease the Aave weight in the pool. This, in return, will attract traders to buy AAVE from the pool since it will cause AAVE to trade at a discount compared to external markets.

Now you might notice that selling tokens for cheaper than the external markets (creating arbitrage opportunities) is not ideal for index token holders who own a share of the pool. This is why PieDAO and Indexed.Finance both charge a swap fee. In the case of Indexed.Finance this fee is 2.5% whereas PieDao charges a 1% fee.

The tradeoff here is the following: a higher fee protects index holders better from impermanent loss but a lower fee attracts more trading volume.

PieDAO & Indexed:

Value appreciation of the index tokens + Trading fees earned - impermanent loss

DPI:

Value appreciation of the index tokens - rebalancing costs (trading fees + slippage) - management fee

PieDAO vs. Indexed Finance

The main difference between PieDao and Indexed relates to their governance. Indexed uses a model that is very “governance light”. All the logic relating to how Indexed.Finance indices re-weight is encoded on-chain. The price data comes from a Uniswap price oracle which triggers the re-weighting of the liquidity pool that we mentioned earlier. Once an index is deployed, governance doesn’t have to do anything except if it wants to update the portfolio contracts or change the methodology of an index.

With PieDao the weights are set by governance votes so it requires more participation. PieDao also has some indices with static weights like the BTC++ or USD++ which don’t require any governance because they are not intended to rebalance.

Summary

Of course, there are other things to watch out for when choosing which DeFi index to buy. The security of the protocol is important, the TVL, the management fees, how the governance is set up and how much token holders can weigh in on important decisions.

Since DeFi indices are a relatively young category within DeFi, it is still too early to benchmark the performance of these various indices. In one year from now, it will be easier to compare which one is most interesting to hold as an investor. The same goes for security. The longer a protocol has existed out there with a significant amount of user funds without being hacked, the more likely it is that its code is secure.

Without a doubt, we can say that exciting new things will happen within the DeFi index space. The fact alone that DeFi index holders can participate in the governance of their favourite index protocol is a 10x improvement over traditional finance. The competition between these various projects is ultimately beneficial for consumers as it will force experimentation and show which DeFi index design is the best.

Emanuel Coen

over 1 year ago ·

12 min read

We are a multi-faceted team of crypto enthusiasts based in Berlin.

© 2021 cryptotesters UG

Products

Cryptocurrency exchanges

Crypto wallet guide

Crypto savings accounts

Defi lending rates

Crypto cards

Exclusive crypto deals

Ethereum staking

Resources

Articles

Reviews

Podcasts

Tutorials